Hardin, Sutton, and Williams have operated a local business as a partnership for several years. All profits and losses have been allocated in a 3:2:1 ratio, respectively. Recently, Williams has undergone personal financial problems, and is insolvent. To satisfy Williams' creditors, the partnership has decided to liquidate.

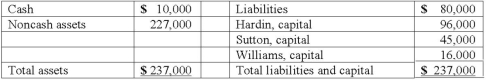

The following balance sheet has been produced:

During the liquidation process, the following transactions take place:

- Noncash assets are sold for $116,000.

- Liquidation expenses of $12,000 are paid. No further expenses are expected.

- Safe capital distributions are made to the partners.

- Payment is made of all business liabilities.

- Any deficit capital balances are deemed to be uncollectible.

Develop a predistribution plan for this partnership, assuming $12,000 of liquidation expenses are expected to be paid.

Definitions:

Respite Care Center

A facility that provides temporary relief for caregivers, offering care and supervision to their loved ones.

Back Injury

Damage or harm to the muscles, bones, or other structures in the back, often caused by physical strain, accidents, or improper lifting techniques.

Multiple Linkage Model

A leadership theory that suggests a leader's effectiveness is linked through several intervening variables between managerial behavior and organizational outcomes.

Group Effectiveness

The degree to which a group achieves its objectives, meets the needs of its members, and maintains team health over time.

Q6: What are the objectives of accounting for

Q17: In the two decades following 2010, millions

Q23: Which one of the following forms is

Q24: How can a parent corporation determine the

Q41: The Abrams, Bartle, and Creighton partnership began

Q47: An executor will normally carry out all

Q53: Norton Co., a U.S. corporation, sold inventory

Q68: A partnership began its first year of

Q71: A city enacted a special tax levy

Q83: Which of the following could be used