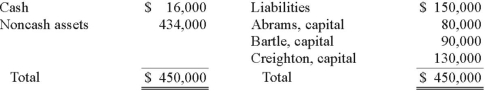

The Abrams, Bartle, and Creighton partnership began the process of liquidation with the following balance sheet:  Abrams, Bartle, and Creighton share profits and losses in a ratio of 3:2:5. Liquidation expenses are expected to be $12,000.

Abrams, Bartle, and Creighton share profits and losses in a ratio of 3:2:5. Liquidation expenses are expected to be $12,000.

If the noncash assets were sold for $234,000, what amount of the loss would have been allocated to Bartle?

Definitions:

Repayment

The act of paying back money that was borrowed.

Mortgage

A secured loan where the borrower pledges real estate as collateral to secure repayment to the lender, often used to purchase property.

Security Interest

A legal right granted by a debtor to a creditor over the debtor's property to secure the repayment of a debt or performance of some other obligation.

Real Property

Land and anything permanently affixed to it, such as buildings and trees.

Q3: The partners of Donald, Chief & Berry

Q6: Which statement is true regarding a foreign

Q17: Which eye care professional makes prescription eyeglasses?<br>A)

Q21: Focus areas of Healthy People 2020 and

Q24: Hampton Company is trying to decide whether

Q30: Under modified accrual accounting, when are expenditures

Q34: The executor of the Estate of Kate

Q47: A partnership had the following account balances:

Q59: The capital account balances for Donald &

Q70: Harding, Jones, and Sandy is in the