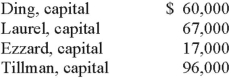

A local partnership was considering the possibility of liquidation since one of the partners (Ding) was personally insolvent. Capital balances at that time were as follows. Profits and losses were divided on a 4:2:2:2 basis, respectively.  Creditors of partner Ding filed a $25,000 claim against the partnership's assets. At that time, the partnership held noncash assets reported at $360,000 and liabilities of $120,000. There was no cash on hand at the time.

Creditors of partner Ding filed a $25,000 claim against the partnership's assets. At that time, the partnership held noncash assets reported at $360,000 and liabilities of $120,000. There was no cash on hand at the time.

If the assets could be sold, for $228,000 what is the minimum amount that Tillman's creditors would have received?

Definitions:

Persuasive

A quality or approach that has the power to convince or influence someone's beliefs, attitudes, or actions.

Complex Ideas

Concepts or notions that have multiple components, are difficult to understand, or require deep thought and analysis.

Scribbled Notes

Hastily or carelessly written down thoughts or information, typically for personal reference.

Formal Reports

Detailed and structured documents presenting information, analysis, or findings, typically used in academic, business, or professional contexts.

Q5: All of the following hedges are used

Q14: The median net income for physicians per

Q20: In not-for-profit accounting, an acquisition occurs when

Q46: A company that was to be liquidated

Q53: Describe the two parts of the SEC

Q60: What are the goals of probate laws?<br>(1)

Q60: A U.S. company sells merchandise to a

Q69: The Albert, Boynton, and Creamer partnership was

Q70: The executor of Danny Mack's estate has

Q70: Hampton Company is trying to decide whether