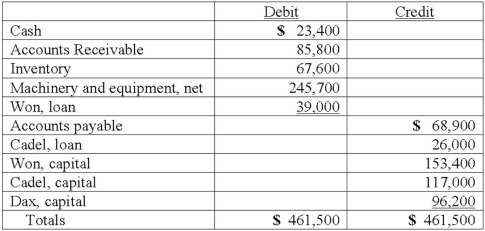

On January 1, 2013, the partners of Won, Cadel, and Dax (who shared profits and losses in the ratio of 5:3:2, respectively) decided to liquidate their partnership. The trial balance at this date was as follows:

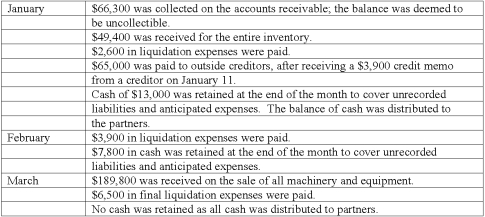

The partners planned a program of piecemeal conversion of the business assets to minimize liquidation losses. All available cash, less an amount retained to provide for future expenses, was to be distributed to the partners at the end of each month. A summary of liquidation transactions follows:

Prepare a schedule to calculate the safe payments to be made to the partners at the end of March.

Definitions:

Regressive

A term typically used to describe a tax system where the tax rate decreases as the taxable amount increases, placing a heavier burden on lower-income individuals.

Wages and Salary

Compensation received by employees for their labor, typically paid as hourly wages or annual salaries.

Taxed

Taxed refers to the imposition of financial charges or other levies upon a taxpayer by a governmental organization in order to fund government spending and various public expenditures.

Percent

A way to express a number as a part of 100, often used to describe proportions and changes in financial and statistical data.

Q1: When a person dies without leaving a

Q4: Which statement is false regarding the Balance

Q5: A market economy is described by all

Q8: Primo Inc., a U.S. company, ordered parts

Q11: The board of commissioners of the city

Q19: Governmental funds are<br>A) Funds used to account

Q36: Which one of the following statements is

Q44: What are the three goals of probate

Q76: In translating a foreign subsidiary's financial statements,

Q80: A partnership began its first year of