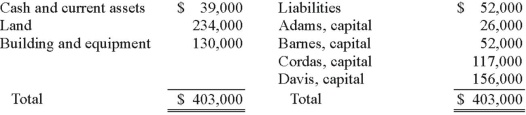

The ABCD Partnership has the following balance sheet at January 1, 2012, prior to the admission of new partner, Eden.

Eden acquired a 20% interest in the partnership by contributing a total of $71,500 directly to the other four partners. No goodwill is to be recorded. Profits and losses have previously been split according to the following percentages: Adams, 15%, Barnes, 35%, Cordas, 30%, and Davis, 20%. After Eden made his investment, what were the individual capital balances?

Definitions:

Q7: Which entry would be the correct entry

Q16: Cherryhill and Hace had been partners for

Q20: Which criteria must be met to be

Q30: Candice Company is currently going through bankruptcy

Q33: In accounting, the term translation refers to<br>A)

Q34: Darron Co. was formed on January 1,

Q35: Which of the following type of organization

Q44: Hardin, Sutton, and Williams have operated a

Q53: Describe the two parts of the SEC

Q71: The Abrams, Bartle, and Creighton partnership began