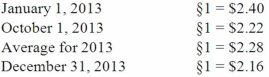

Ginvold Co. began operating a subsidiary in a foreign country on January 1, 2013 by acquiring all of the common stock for §50,000 Stickles, the local currency. This subsidiary immediately borrowed §120,000 on a five-year note with ten percent interest payable annually beginning on January 1, 2014. A building was then purchased for §170,000 on January 1, 2013. This property had a ten-year anticipated life and no salvage value and was to be depreciated using the straight-line method. The building was immediately rented for three years to a group of local doctors for §6,000 per month. By year-end, payments totaling §60,000 had been received. On October 1, §5,000 were paid for a repair made on that date and it was the only transaction of this kind for the year. A cash dividend of §6,000 was transferred back to Ginvold on December 31, 2013. The functional currency for the subsidiary was the Stickle (§). Currency exchange rates were as follows:

Prepare a statement of cash flows for this subsidiary in stickles and then translate the amounts into U.S. dollars.

Definitions:

Monetary Awards

Financial rewards given to employees or organizations as recognition for achievements or meeting particular standards.

First-Year Savings

The amount of money saved during the first year of implementing a particular strategy, policy, or change.

Preventive Discipline

A proactive approach to discipline that focuses on identifying and addressing issues before they escalate into serious problems.

Infraction

A violation or infringement of a rule, agreement, or law.

Q12: Dean, Inc. owns 90 percent of Ralph,

Q14: What information is conveyed by the Statement

Q17: Betsy Kirkland, Inc. incurred a flood loss

Q18: Tower Company owns 85% of Hill Company.

Q20: Under the temporal method, depreciation expense would

Q49: Under the current rate method, property, plant

Q65: What is included in Part I of

Q95: Blanton Corporation is comprised of five operating

Q109: Bauerly Co. owned 70% of the voting

Q111: Panton, Inc. acquired 18,000 shares of Glotfelty