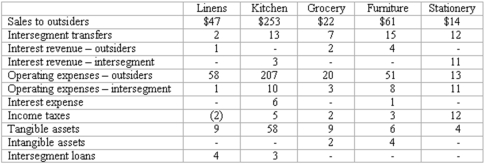

Blanton Corporation is comprised of five operating segments. Information about each of these segments is as follows (in thousands):

Required:

(a.) Which operating segments are reportable under the revenue test?

(b.) What is the total amount of revenues in applying the revenues test?

(c.) Which operating segments are reportable under the profit or loss test?

(d.) In applying the profit or loss test, what is the minimum amount an operating segment must have in order to meet the profit or loss test for a reportable segment?

(e.) Which operating segments are reportable under the asset test?

(f.) In applying the asset test, what is the minimum amount an operating segment must have in order to meet the asset test for a reportable segment?

(g.) Which operating segments are reportable?

(h.) According to the test results for reportable segments, is there a sufficient number of reported segments or should any additional segments also be disclosed? Explain the reason for your conclusion.

Definitions:

Experimental Control

The process of keeping all variables in a study constant except the one being tested to ensure that any changes in the outcome can be attributed to the variable under investigation.

Clinical Judgment

The process by which healthcare professionals make decisions regarding the diagnosis and treatment of patient health conditions.

Intuition

the ability to understand or know something immediately, without the need for conscious reasoning, often perceived as a "gut feeling."

Spontaneous Improvements

Refers to unexpected, unexplained improvements in a condition or performance without deliberate intervention or treatment.

Q3: Quincy Corp., about to be liquidated, has

Q5: All of the following hedges are used

Q40: The hardware operating segment of Bloom Corporation

Q51: U.S. GAAP provides guidance for hedges of

Q51: What is the purpose of the SEC's

Q64: Stark Company, a 90% owned subsidiary of

Q68: Hampton Company is trying to decide whether

Q69: What is the appropriate treatment in an

Q86: Alpha Corporation owns 100 percent of Beta

Q97: How would you determine the amount of