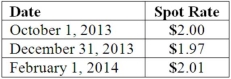

On October 1, 2013, Eagle Company forecasts the purchase of inventory from a British supplier on February 1, 2014, at a price of 100,000 British pounds. On October 1, 2013, Eagle pays $1,800 for a three-month call option on 100,000 pounds with a strike price of $2.00 per pound. The option is considered to be a cash flow hedge of a forecasted foreign currency transaction. On December 31, 2013, the option has a fair value of $1,600. The following spot exchange rates apply:  What is the amount of Cost of Goods Sold for 2014 as a result of these transactions?

What is the amount of Cost of Goods Sold for 2014 as a result of these transactions?

Definitions:

Ovulation

The process in the female reproductive cycle where an ovary releases an egg, making it available for fertilization.

Intrauterine Device

A form of long-term contraceptive placed inside the uterus to prevent pregnancy, available in hormonal and non-hormonal (copper) types.

Psychosocial History

An overview of an individual's past and present personal relationships, social interaction patterns, and psychological well-being.

Tobacco Cessation

The process of discontinuing tobacco smoking.

Q8: Dithers Inc. acquired all of the common

Q10: Strickland Company sells inventory to its parent,

Q24: How can a parent corporation determine the

Q25: Strayten Corp. is a wholly owned subsidiary

Q26: White Company owns 60% of Cody Company.

Q35: West Corp. owned 70% of the voting

Q42: Boerkian Co. started 2013 with two assets:

Q43: Cement Company, Inc. began the first quarter

Q76: Parker Corp., a U.S. company, had the

Q86: Certain balance sheet accounts of a foreign