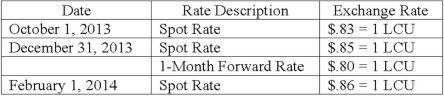

On October 1, 2013, Jarvis Co. sold inventory to a customer in a foreign country, denominated in 100,000 local currency units (LCU). Collection is expected in four months. On October 1, 2013, a forward exchange contract was acquired whereby Jarvis Co. was to pay 100,000 LCU in four months (on February 1, 2014) and receive $78,000 in U.S. dollars. The spot and forward rates for the LCU were as follows:

The company's borrowing rate is 12%. The present value factor for one month is .9901.

Any discount or premium on the contract is amortized using the straight-line method.

Assuming this is a fair value hedge; prepare journal entries for this sales transaction and forward contract.

Definitions:

Rescind Agreement

The legal act of unilaterally canceling or terminating a contract by one of the parties involved, effectively restoring the parties to their state before the contract was signed.

Whistle-blower

An individual who exposes illegal, unethical, or wrong practices within an organization to the public or authorities.

SEC

The U.S. Securities and Exchange Commission, a federal agency responsible for enforcing federal securities laws and regulating the securities industry.

Illegal Accounting Procedures

Practices in accounting that violate laws or regulations, often intended to conceal true financial performance or to deceive stakeholders.

Q2: On January 1, 2012, Jones Company bought

Q17: Kennedy Company acquired all of the outstanding

Q20: Stiller Company, an 80% owned subsidiary of

Q48: According to U.S. GAAP for a local

Q57: What is meant by harmonization of accounting

Q59: What term is used for a bankruptcy

Q62: Coyote Corp. (a U.S. company in Texas)

Q71: Cleary, Wasser, and Nolan formed a partnership

Q105: Pepe, Incorporated acquired 60% of Devin Company

Q120: On April 7, 2013, Pate Corp. sold