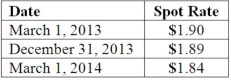

On March 1, 2013, Mattie Company received an order to sell a machine to a customer in England at a price of 200,000 British pounds. The machine was shipped and payment was received on March 1, 2014. On March 1, 2013, Mattie purchased a put option giving it the right to sell 200,000 British pounds on March 1, 2014 at a price of $380,000. Mattie properly designates the option as a fair hedge of the pound firm commitment. The option cost $2,000 and had a fair value of $2,200 on December 31, 2013. The following spot exchange rates apply:  Mattie's incremental borrowing rate is 12 percent, and the present value factor for two months at a 12 percent annual rate is .9803.

Mattie's incremental borrowing rate is 12 percent, and the present value factor for two months at a 12 percent annual rate is .9803.

What was the net impact on Mattie's 2014 income as a result of this fair value hedge of a firm commitment?

Definitions:

Put Option

A financial contract that gives the holder the right, but not the obligation, to sell a specified amount of an underlying asset at a set price within a specified period.

Exercise Price

The price at which the holder of an option can buy (in case of a call option) or sell (in case of a put option) the underlying asset.

Put-call Parity

A principle stating the relationship between the prices of European put and call options with the same strike price and expiration date.

American Put Values

The value of an American put option, which allows the holder to sell a specific asset at a predetermined price before the option expires.

Q8: Tower Company owns 85% of Hill Company.

Q22: On January 1, 2013, Veldon Co., a

Q35: An intra-entity sale took place whereby the

Q45: Danbers Co. owned seventy-five percent of the

Q59: The capital account balances for Donald &

Q67: Coyote Corp. (a U.S. company in Texas)

Q68: Hampton Company is trying to decide whether

Q70: Tray Co. reported current earnings of $560,000

Q72: Whitley Corporation identified four operating segments: Automotive,

Q83: All of the following are examples of