These questions are based on the following information and should be viewed as independent situations.

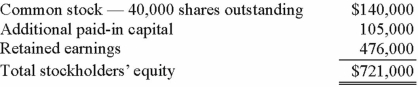

Popper Co. acquired 80% of the common stock of Cocker Co. on January 1, 2011, when Cocker had the following stockholders' equity accounts.

To acquire this interest in Cocker, Popper paid a total of $682,000 with any excess acquisition date fair value over book value being allocated to goodwill, which has been measured for impairment annually and has not been determined to be impaired as of January 1, 2014.

On January 1, 2014, Cocker reported a net book value of $1,113,000 before the following transactions were conducted. Popper uses the equity method to account for its investment in Cocker, thereby reflecting the change in book value of Cocker.

On January 1, 2014, Cocker issued 10,000 additional shares of common stock for $21 per share. Popper did not acquire any of this newly issued stock. How would this transaction affect the additional paid-in capital of the parent company?

Definitions:

Iris

The pigment-rich section of the eye responsible for regulating pupil size and controlling the influx of light.

Receptor Cell

Receptor cells are specialized cells found in the sensory organs that respond to specific stimuli, such as light, sound, or chemicals, and convert them into neural signals.

Seeing Colors

The ability of the eye and brain to interpret various wavelengths of light as different colors, a process involving the retina's cone cells.

Cones

Photoreceptor cells in the retina of the eye that function best in bright light and enable color vision.

Q2: Pot Co. holds 90% of the common

Q5: Kennedy Company acquired all of the outstanding

Q13: The financial statements for Goodwin, Inc. and

Q30: The translation adjustment from translating a foreign

Q33: Perch Co. acquired 80% of the common

Q37: Which of the following statements is true?<br>A)

Q64: Meisner Co. ordered parts costing §100,000 for

Q88: Gargiulo Company, a 90% owned subsidiary of

Q97: Vapor Corporation has a fan products operating

Q103: West Corp. owned 70% of the voting