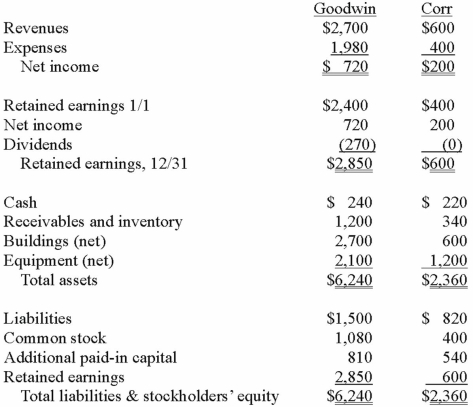

The financial statements for Goodwin, Inc. and Corr Company for the year ended December 31, 2013, prior to Goodwin's acquisition business combination transaction regarding Corr, follow (in thousands) :  On December 31, 2013, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

On December 31, 2013, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

Compute the consolidated buildings (net) account at December 31, 2013.

Definitions:

Bonds Payable

Long-term liabilities representing money a company must pay back to bondholders, typically including principal and interest.

Semiannual Interest

Interest that is calculated and paid twice a year on an investment or loan.

Bond Discount

The contrast in value between what a bond is worth in terms of its face value and the lesser amount it is sold for in the market.

Interest Method

A method used in finance to calculate the interest portion of a payment or the return on an investment over a period of time.

Q7: If a locus on chromosome 16 is

Q7: Which of the following pieces of information

Q15: Which of the following is a genetic

Q17: A pedigree was examined over four generations

Q30: Wathan Inc. sold $180,000 in inventory to

Q55: The financial statements for Goodwin, Inc. and

Q60: Which of the following statements is false

Q71: Idler Co. has an investment in Cowl

Q80: When applying the equity method, how is

Q104: When is a goodwill impairment loss recognized?<br>A)