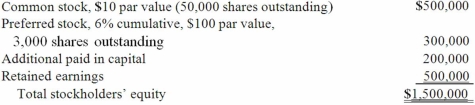

On January 1, 2013, Nichols Company acquired 80% of Smith Company's common stock and 40% of its non-voting, cumulative preferred stock. The consideration transferred by Nichols was $1,200,000 for the common and $124,000 for the preferred. Any excess acquisition-date fair value over book value is considered goodwill. The capital structure of Smith immediately prior to the acquisition is:  Determine the amount and account to be recorded for Nichols' investment in Smith.

Determine the amount and account to be recorded for Nichols' investment in Smith.

Definitions:

Actual Value

The real value observed or measured, as opposed to an estimated or theoretical value.

Sample Mean

is the average value of a subset of observations from a larger population.

Sample Variance

Sample variance is a measure of the dispersion or variability of a sample dataset, calculating how much the numbers differ from the sample mean.

Consistent

A statistical property indicating that as the size of the sample increases, the estimator converges in probability to the parameter being estimated.

Q6: Patti Company owns 80% of the common

Q9: The following information has been taken from

Q15: How are intra-entity inventory transfers treated on

Q26: Sinkal Co. was formed on January 1,

Q28: Coyote Corp. (a U.S. company in Texas)

Q43: One company acquires another company in a

Q50: Pell Company acquires 80% of Demers Company

Q55: Paris, Inc. owns 80 percent of the

Q58: The following information pertains to inventory held

Q62: Which of the following are required to