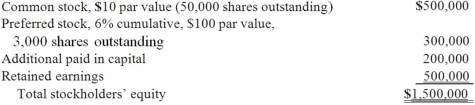

On January 1, 2013, Nichols Company acquired 80% of Smith Company's common stock and 40% of its non-voting, cumulative preferred stock. The consideration transferred by Nichols was $1,200,000 for the common and $124,000 for the preferred. Any excess acquisition-date fair value over book value is considered goodwill. The capital structure of Smith immediately prior to the acquisition is:  Compute the goodwill recognized in consolidation.

Compute the goodwill recognized in consolidation.

Definitions:

Net Realisable Value

is the estimated selling price of goods in the ordinary course of business minus the estimated costs of completion and the necessary selling expenses, used in inventory valuation and impairment tests.

Depreciation

A method of allocating the cost of a tangible or physical asset over its useful life, recognizing the asset's wear and tear over time.

Asset's Value

The worth of an asset, which can be determined by factors such as market value, book value, or utility.

Useful Life

is the estimated duration of time an asset is expected to remain productive for the entity, used in calculating depreciation and amortization.

Q9: When a company applies the initial method

Q15: Tate, Inc. owns 80 percent of Jeffrey,

Q33: The following information has been taken from

Q44: On January 1, 2012, Mace Co. acquired

Q45: In a tax-free business combination,<br>A) the income

Q47: Which method of translating a foreign subsidiary's

Q49: What is the purpose of the U.S.

Q65: Williams Inc., a U.S. company, has a

Q97: A historical exchange rate for common stock

Q97: How would you determine the amount of