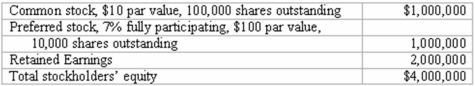

On January 1, 2013, Harrison Corporation spent $2,600,000 to acquire control over Involved, Inc. This price was based on paying $750,000 for 30 percent of Involved's preferred stock, and $1,850,000 for 80 percent of its outstanding common stock. As of the date of the acquisition, Involved's stockholders' equity accounts were as follows:  Assuming Involved's accounts are correctly valued within the company's financial statements, what amount of goodwill should be recognized for the Investment in Involved?

Assuming Involved's accounts are correctly valued within the company's financial statements, what amount of goodwill should be recognized for the Investment in Involved?

Definitions:

Agreement to Divorce

A mutual understanding or contract between spouses to legally end their marriage.

Statutes

Written laws enacted by a legislative body at the federal, state, or local level.

Revenue Raising

The process or measures taken by government or organizations to generate income, often through taxes, fees, or the sale of goods and services.

Public Policy

Principles and standards considered by the legislative body to be of benefit to the public and used as a guide to govern actions.

Q21: Pell Company acquires 80% of Demers Company

Q39: Pell Company acquires 80% of Demers Company

Q39: Ginvold Co. began operating a subsidiary in

Q62: Coyote Corp. (a U.S. company in Texas)

Q68: Hambly Corp. owned 80% of the voting

Q73: The financial balances for the Atwood Company

Q78: A net asset balance sheet exposure exists

Q79: Pell Company acquires 80% of Demers Company

Q111: Pell Company acquires 80% of Demers Company

Q116: Which of the following statements is false