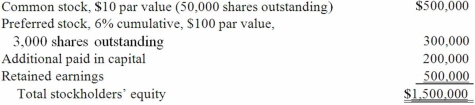

On January 1, 2013, Nichols Company acquired 80% of Smith Company's common stock and 40% of its non-voting, cumulative preferred stock. The consideration transferred by Nichols was $1,200,000 for the common and $124,000 for the preferred. Any excess acquisition-date fair value over book value is considered goodwill. The capital structure of Smith immediately prior to the acquisition is:  If Smith's net income is $100,000 in the year following the acquisition,

If Smith's net income is $100,000 in the year following the acquisition,

Definitions:

Advantage

A condition or circumstance that places a person or entity in a favorable or superior position.

Import Quotas

Restrictions imposed by a government on the amount or value of goods that can be imported into a country, often used to protect domestic industries.

Tariffs

Taxes imposed by a government on imported goods and services.

Revenue

The sum of revenue resulting from the sales of products or services that are central to a company's main business activities.

Q16: Where do dividends paid to the non-controlling

Q41: Quadros Inc., a Portuguese firm was acquired

Q43: Westmore Ltd., is a British subsidiary of

Q47: What is the impact on the non-controlling

Q51: Elektronix, Inc. has three operating segments with

Q54: The following information has been taken from

Q68: The financial statements for Goodwin, Inc. and

Q92: Which of the following would be an

Q104: When comparing the difference between an upstream

Q112: Carlson, Inc. owns 80 percent of Madrid,