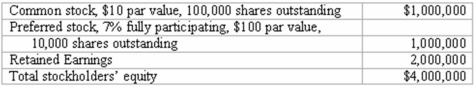

On January 1, 2013, Harrison Corporation spent $2,600,000 to acquire control over Involved, Inc. This price was based on paying $750,000 for 30 percent of Involved's preferred stock, and $1,850,000 for 80 percent of its outstanding common stock. As of the date of the acquisition, Involved's stockholders' equity accounts were as follows:  What is the total acquisition-date fair value of Involved?

What is the total acquisition-date fair value of Involved?

Definitions:

Future Event

An occurrence or situation that has not yet happened but is expected or anticipated.

Accounts Payable

Liabilities of a business that are owed to creditors for goods and services purchased on credit.

Estimated

An approximate calculation or judgment regarding a number, value, or size based on available data, often used in planning and forecasting.

Liabilities

Economic responsibilities or liabilities that a business must pay back to others, requiring the disbursement of economic resources over a period.

Q11: Wolff Corporation owns 70 percent of the

Q13: Which accounts are remeasured using current exchange

Q25: In reporting consolidated earnings per share when

Q32: According to GAAP, the pooling of interest

Q49: Under the current rate method, property, plant

Q54: Baker Corporation changed from the LIFO method

Q57: Push-down accounting is concerned with the<br>A) impact

Q58: For an acquisition when the subsidiary maintains

Q66: Where may a non-controlling interest be presented

Q110: Walsh Company sells inventory to its subsidiary,