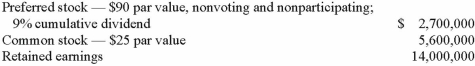

Thomas Inc. had the following stockholders' equity accounts as of January 1, 2013:

Kuried Co. acquired all of the voting common stock of Thomas on January 1, 2013, for $20,656,000. The preferred stock remained in the hands of outside parties and had a fair value of $3,060,000. A database valued at $656,000 was recognized and amortized over five years.

During 2013, Thomas reported earning $630,000 in net income and paid $504,000 in total cash dividends. Kuried used the equity method to account for this investment.

What is the controlling interest share of Thomas' net income for the year ended December 31, 2013?

Definitions:

Tax-Reduction

Strategies or actions taken to minimize the amount of taxes owed by an individual or corporation.

Asset Cost

The total amount invested to acquire, produce, or improve a tangible or intangible asset, utilized for accounting and tax purposes.

Lease-Purchase Analysis

A financial evaluation technique used to determine the most cost-effective option between leasing an asset and purchasing it outright.

Sale and Leaseback

A financial transaction where one sells an asset and leases it back for the long-term; thus, one continues to be able to use the asset but does not own it.

Q7: One company acquires another company in a

Q17: For each of the following situations, select

Q33: Which of the following is not a

Q42: When a company applies the partial equity

Q44: Following are selected accounts for Green Corporation

Q49: What is the purpose of the U.S.

Q66: The following information has been taken from

Q67: Pot Co. holds 90% of the common

Q109: Anderson, Inc. has owned 70% of its

Q110: Elektronix, Inc. has three operating segments with