Several years ago Polar Inc. acquired an 80% interest in Icecap Co. The book values of Icecap's asset and liability accounts at that time were considered to be equal to their fair values. Polar's acquisition value corresponded to the underlying book value of Icecap so that no allocations or goodwill resulted from the transaction.

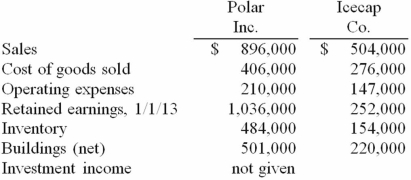

The following selected account balances were from the individual financial records of these two companies as of December 31, 2013:

Assume that Polar sold inventory to Icecap at a markup equal to 25% of cost. Intra-entity transfers were $130,000 in 2012 and $165,000 in 2013. Of this inventory, $39,000 of the 2012 transfers were retained and then sold by Icecap in 2013, while $55,000 of the 2013 transfers were held until 2014.

Required:

For the consolidated financial statements for 2013, determine the balances that would appear for the following accounts: (1) Cost of Goods Sold, (2) Inventory, and (3) Non-controlling Interest in Subsidiary's Net Income.

Definitions:

Profit-sharing Plan

A retirement plan that gives employees a share in the profits of the company. Each employee receives a percentage of those profits based on the company's earnings.

Defined-benefit Plans

Retirement plans that promise a specific pension payment upon retirement, based on salary and years of service.

Definitely Determinable Benefits

Benefits from a pension plan or retirement account that are calculable and guaranteed based on factors like salary history and years of service.

Coverdell Education Savings Account

A tax-advantaged savings account designed to pay educational expenses, including tuition, fees, books, and supplies.

Q9: Delta Corporation owns 90 percent of Sigma

Q10: Retro Corp. was engaged solely in manufacturing

Q42: On February 23, 2013, Cleveland, Inc. paid

Q43: Cement Company, Inc. began the first quarter

Q47: A company had common stock with a

Q49: Which of the following statements is true

Q70: The financial balances for the Atwood Company

Q97: When is a goodwill impairment loss recognized?<br>A)

Q113: McGuire Company acquired 90 percent of Hogan

Q119: On January 4, 2013, Watts Co. purchased