On January 1, 2013, Vacker Co. acquired 70% of Carper Inc. by paying $650,000. This included a $20,000 control premium. Carper reported common stock on that date of $420,000 with retained earnings of $252,000. A building was undervalued in the company's financial records by $28,000. This building had a ten-year remaining life. Copyrights of $80,000 were to be recognized and amortized over 20 years.

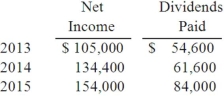

Carper earned income and paid cash dividends as follows:

On December 31, 2015, Vacker owed $30,800 to Carper. There have been no changes in Carper's common stock account since the acquisition.

Required:

If the equity method had been applied by Vacker for this acquisition, what were the consolidation entries needed as of December 31, 2015?

Definitions:

Estimating

The process of calculating or judging the approximate value, size, or worth of something.

Skin Test

A medical test in which the skin is lightly punctured or injected with a substance to check for an allergic reaction or the presence of a disease.

Abbreviation

A shortened form of a word or phrase.

Skin Test

A medical test where a small amount of substance is placed on or under the skin to check for an allergic reaction or disease.

Q4: Pell Company acquires 80% of Demers Company

Q23: Thomas Inc. had the following stockholders' equity

Q29: Five one- and two-base repeat loci were

Q32: An intra-entity sale took place whereby the

Q44: The following information has been taken from

Q50: Pell Company acquires 80% of Demers Company

Q73: Throughout 2013, Cleveland Co. sold inventory to

Q101: On January 1, 2013, the Moody Company

Q105: White Company owns 60% of Cody Company.

Q122: What accounting method requires a subsidiary to