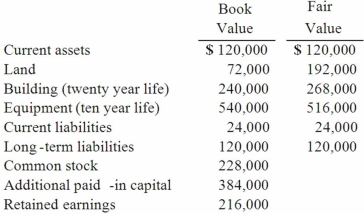

On January 1, 2012, Cale Corp. paid $1,020,000 to acquire Kaltop Co. Kaltop maintained separate incorporation. Cale used the equity method to account for the investment. The following information is available for Kaltop's assets, liabilities, and stockholders' equity accounts on January 1, 2012:  Kaltop earned net income for 2012 of $126,000 and paid dividends of $48,000 during the year.

Kaltop earned net income for 2012 of $126,000 and paid dividends of $48,000 during the year.

In Cale's accounting records, what amount would appear on December 31, 2012 for equity in subsidiary earnings?

Definitions:

Financial Statement Presentation

The manner in which a company's financial data is organized and displayed in its financial statements.

Comprehensive Income

The total change in equity for a reporting period that comes from transactions, other events, and circumstances from sources not directly related to investments by or distributions to equity shareholders.

Unrealized Changes

Refers to changes in the value of assets or liabilities that have occurred but have not been realized through a transaction.

Earnings Per Share

A measure of a company's profitability calculated by dividing net income by the number of outstanding shares.

Q4: Graft rejection of MHC-identical transplants can be

Q23: The level of detail to which an

Q28: Which of the following is a clinical

Q42: Delta Corporation owns 90 percent of Sigma

Q46: Cashen Co. paid $2,400,000 to acquire all

Q88: Bullen Inc. acquired 100% of the voting

Q95: Blanton Corporation is comprised of five operating

Q98: Cashen Co. paid $2,400,000 to acquire all

Q105: Pepe, Incorporated acquired 60% of Devin Company

Q117: On January 1, 2013, Payton Co. sold