Jans Inc. acquired all of the outstanding common stock of Tysk Corp. on January 1, 2011, for $372,000. Equipment with a ten-year life was undervalued on Tysk's financial records by $46,000. Tysk also owned an unrecorded customer list with an assessed fair value of $67,000 and an estimated remaining life of five years.

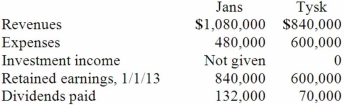

Tysk earned reported net income of $180,000 in 2011 and $216,000 in 2012. Dividends of $70,000 were paid in each of these two years. Selected account balances as of December 31, 2013, for the two companies follow.

If the partial equity method had been applied, what was 2013 consolidated net income?

Definitions:

Competitive Price-Searcher

A market structure where firms have some control over the price because their products are differentiated, and consumers search for the best prices among competitors.

Long-Run Economic Profit

The excess revenue over costs, including opportunity costs and explicit costs, that a firm realizes when all inputs are considered variable, typically assumed in a period where firms can enter or exit the industry.

Potential Rivals

Companies or entities not currently in the market but possess the capability to enter and compete effectively.

Monopoly

A market structure characterized by a single seller, selling a unique product in the market.

Q3: Beatty, Inc. acquires 100% of the voting

Q8: What is the relationship between the number

Q8: Tower Company owns 85% of Hill Company.

Q10: In PCR-SSOP methods for HLA typing, the

Q14: Panton, Inc. acquired 18,000 shares of Glotfelty

Q42: Delta Corporation owns 90 percent of Sigma

Q51: Perry Company acquires 100% of the stock

Q82: During 2012, Von Co. sold inventory to

Q105: What advantages might push-down accounting offer for

Q108: Alpha Corporation owns 100 percent of Beta