Jans Inc. acquired all of the outstanding common stock of Tysk Corp. on January 1, 2011, for $372,000. Equipment with a ten-year life was undervalued on Tysk's financial records by $46,000. Tysk also owned an unrecorded customer list with an assessed fair value of $67,000 and an estimated remaining life of five years.

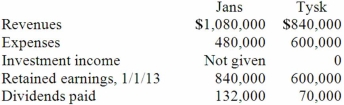

Tysk earned reported net income of $180,000 in 2011 and $216,000 in 2012. Dividends of $70,000 were paid in each of these two years. Selected account balances as of December 31, 2013, for the two companies follow.

If the equity method had been applied, what would be the Investment in Tysk Corp. account balance within the records of Jans at the end of 2013?

Definitions:

Stocks and Bonds

Financial instruments; stocks represent ownership shares in a company, while bonds are loan agreements between the bond issuer and an investor.

Comparable Units

Units or measures that are similar enough in key aspects to be used in comparisons or evaluations.

Certificates of Deposit

A savings certificate with a fixed maturity date and specified fixed interest rate that is issued by banks and is insured by the Federal Deposit Insurance Corporation (FDIC) up to a certain amount.

Q31: Fargus Corporation owned 51% of the voting

Q51: McLaughlin, Inc. acquires 70 percent of Ellis

Q77: Jull Corp. owned 80% of Solaver Co.

Q87: Stevens Company has had bonds payable of

Q93: On January 1, 2013, the Moody Company

Q94: Dean, Inc. owns 90 percent of Ralph,

Q101: Cayman Inc. bought 30% of Maya Company

Q102: Franklin Corporation owns 90 percent of the

Q105: On January 4, 2012, Harley, Inc. acquired

Q107: McGuire Company acquired 90 percent of Hogan