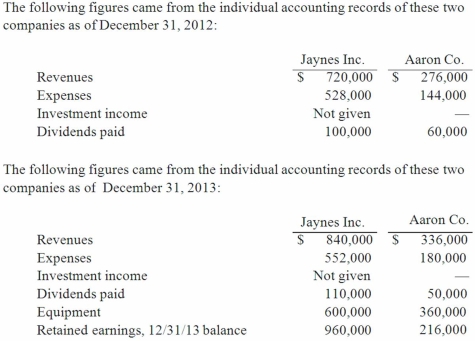

Jaynes Inc. acquired all of Aaron Co.'s common stock on January 1, 2012, by issuing 11,000 shares of $1 par value common stock. Jaynes' shares had a $17 per share fair value. On that date, Aaron reported a net book value of $120,000. However, its equipment (with a five-year remaining life) was undervalued by $6,000 in the company's accounting records. Any excess of consideration transferred over fair value of assets and liabilities is assigned to an unrecorded patent to be amortized over ten years.

What was the total for consolidated patents as of December 31, 2013?

Definitions:

Qualitatively

In a manner that pertains to the quality or characteristics of something, often through descriptive or subjective measures, rather than quantitative or numerical terms.

Quantitatively

In a manner that can be measured or expressed in numbers.

Dan Sullivan

The name of an individual, which without further context, cannot be uniquely defined. In business, Dan Sullivan could refer to a strategic coach or business advisor among others.

Entrepreneurs

Individuals who identify a business opportunity and take the risk of creating and managing a new enterprise to capitalize on it.

Q1: Mass spectrometry detects what type or particles?<br>A)

Q11: The financial statements for Jode Inc. and

Q11: McGuire Company acquired 90 percent of Hogan

Q16: A PCR assay is performed on a

Q30: An outbreak of Salmonella has occurred in

Q56: Acker Inc. bought 40% of Howell Co.

Q64: Pell Company acquires 80% of Demers Company

Q73: On January 1, 2012, Jumper Co. acquired

Q103: MacDonald, Inc. owns 80 percent of the

Q107: Jarmon Company owns twenty-three percent of the