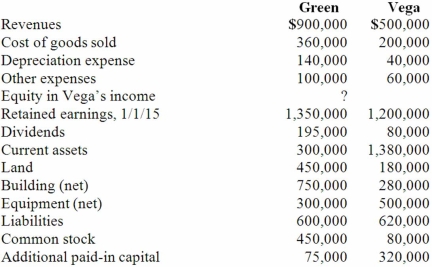

Following are selected accounts for Green Corporation and Vega Company as of December 31, 2015. Several of Green's accounts have been omitted.  Green acquired 100% of Vega on January 1, 2011, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2011, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.

Green acquired 100% of Vega on January 1, 2011, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2011, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.

Compute the December 31, 2015, consolidated equipment.

Definitions:

Common-value Auction

An auction format where the item for sale has the same value for everyone but the bidders have different information about that value.

Exact Value

Precise numerical value without approximation, representing the true measure or count of something.

Bidders

Individuals or entities that offer a specific price for goods, services, or assets in auctions or competitive tenders.

Expected Price

The price level that purchasers or sellers anticipate a good or service will have in the future.

Q2: A woman calls and asks that the

Q3: Flynn acquires 100 percent of the outstanding

Q8: A melt curve analysis was performed to

Q9: In Maxam-Gilbert sequencing, a band that is

Q25: Which of the following molecular-based assays targets

Q39: Strickland Company sells inventory to its parent,

Q58: On January 1, 2013, Pride, Inc. acquired

Q69: The financial balances for the Atwood Company

Q75: Perry Company acquires 100% of the stock

Q88: On January 1, 2013, Nichols Company acquired