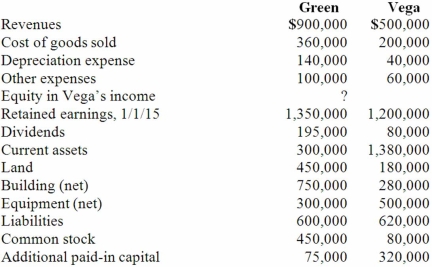

Following are selected accounts for Green Corporation and Vega Company as of December 31, 2015. Several of Green's accounts have been omitted.  Green acquired 100% of Vega on January 1, 2011, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2011, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.

Green acquired 100% of Vega on January 1, 2011, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2011, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.

Compute the equity in Vega's income to be included in Green's consolidated income statement for 2015.

Definitions:

Debiting Interest Receivable

The process of recording the amount of interest earned but not yet received in cash as an asset in the accounting records.

Increase Liabilities

The process or action that results in a higher amount of obligations or debts owed by an entity to others.

Decrease Net Income

Refers to a reduction in the net earnings as reported on an entity's income statement, influenced by costs, expenses, or losses.

Accrual

The accounting method that recognizes revenues and expenses when they are incurred, regardless of when cash transactions occur.

Q12: Prior to being united in a business

Q13: Herceptin (trastuzumab) therapy works best on what

Q15: An assay that detects an analyte associated

Q35: Racer Corp. acquired all of the common

Q43: Dodge, Incorporated acquires 15% of Gates Corporation

Q63: Patti Company owns 80% of the common

Q66: The financial statements for Goodwin, Inc. and

Q69: Which of the following conditions will allow

Q98: Carnes has the following account balances as

Q100: What is the justification for the timing