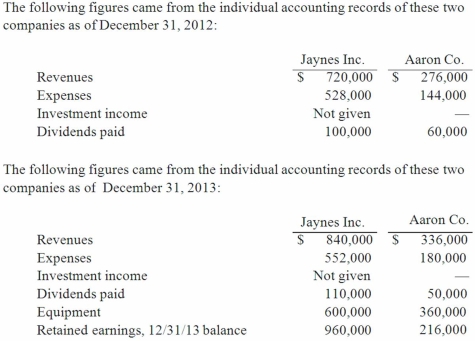

Jaynes Inc. acquired all of Aaron Co.'s common stock on January 1, 2012, by issuing 11,000 shares of $1 par value common stock. Jaynes' shares had a $17 per share fair value. On that date, Aaron reported a net book value of $120,000. However, its equipment (with a five-year remaining life) was undervalued by $6,000 in the company's accounting records. Any excess of consideration transferred over fair value of assets and liabilities is assigned to an unrecorded patent to be amortized over ten years.

What was the total for consolidated patents as of December 31, 2013?

Definitions:

Company Approval

The formal consent or authorization given by a company's governing body or decision-makers to proceed with a proposed action or project.

Collaborative Consumption Services

A business model that involves sharing access to goods or services rather than owning them outright, often facilitated by technology.

Higher Pay

Compensation that is above the average or expected amount for a job, often used as an incentive to attract or retain employees.

Flexible Hours

Work arrangements allowing employees to vary their start and end times, providing greater control over personal schedules.

Q1: PCR with RFLP analysis and reverse hybridization

Q6: Patti Company owns 80% of the common

Q16: When consolidating a subsidiary under the equity

Q52: Strickland Company sells inventory to its parent,

Q57: On January 1, 2013, Jackie Corp. purchased

Q72: For each of the following situations, select

Q72: Which of the following will result in

Q89: Which of the following is not a

Q110: Parrett Corp. acquired one hundred percent of

Q117: Prince Company acquires Duchess, Inc. on January