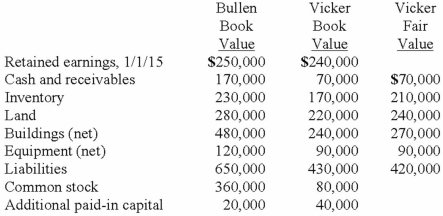

Bullen Inc. acquired 100% of the voting common stock of Vicker Inc. on January 1, 2013. The book value and fair value of Vicker's accounts on that date (prior to creating the combination) follow, along with the book value of Bullen's accounts:  Assume that Bullen issued 12,000 shares of common stock with a $5 par value and a $42 fair value for all of the outstanding stock of Vicker. What is the consolidated balance for Land as a result of this acquisition transaction?

Assume that Bullen issued 12,000 shares of common stock with a $5 par value and a $42 fair value for all of the outstanding stock of Vicker. What is the consolidated balance for Land as a result of this acquisition transaction?

Definitions:

Best Case Scenario

The most favorable or desirable outcome possible in a situation, often used in planning or forecasting.

Storeowner

is an individual who owns and possibly operates a retail establishment, responsible for the management, decision making, and financial outcomes of the store.

Profitable to Develop

Refers to projects or initiatives that are expected to yield a financial gain upon development or implementation.

Complicated Technology

Advanced and often sophisticated technology that may be difficult to understand or operate.

Q10: Which is not intended for diagnostic use?<br>A)

Q13: Herceptin (trastuzumab) therapy works best on what

Q15: Perry Company acquires 100% of the stock

Q22: On January 4, 2013, Bailey Corp. purchased

Q42: When a company applies the partial equity

Q46: Webb Company owns 90% of Jones Company.

Q64: Perry Company acquires 100% of the stock

Q94: Pursley, Inc. owns 70 percent of Harry

Q97: On January 4, 2013, Mason Co. purchased

Q101: Watkins, Inc. acquires all of the outstanding