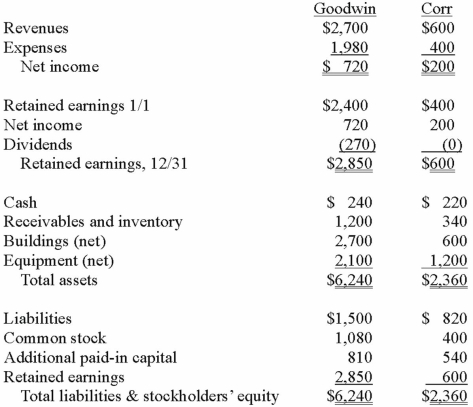

The financial statements for Goodwin, Inc. and Corr Company for the year ended December 31, 2013, prior to Goodwin's acquisition business combination transaction regarding Corr, follow (in thousands) :  On December 31, 2013, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

On December 31, 2013, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

Compute the consolidated receivables and inventory for 2013.

Definitions:

Motor Vehicle Accident

An event involving a collision between one or more vehicles, potentially leading to property damage, injury, or death.

Hearing Loss

A reduction in the ability to perceive sounds compared to what is considered normal, which can range from mild to profound impairment.

Conduction Deafness

A form of hearing loss that occurs due to problems in transferring sound waves from the outer ear to the inner ear.

Auditory Nervous System

The part of the nervous system responsible for hearing; it includes both the peripheral components, like the ear, and the central components, like the brain's auditory pathways.

Q4: Pell Company acquires 80% of Demers Company

Q10: Strickland Company sells inventory to its parent,

Q21: How are bargain purchases accounted for in

Q24: For each of the following numbered situations

Q30: Which of the following techniques is a

Q35: On January 2, 2012, Hull Corp. paid

Q77: Pepe, Incorporated acquired 60% of Devin Company

Q77: In a step acquisition, which of the

Q116: When Jolt Co. acquired 75% of the

Q119: X-Beams Inc. owned 70% of the voting