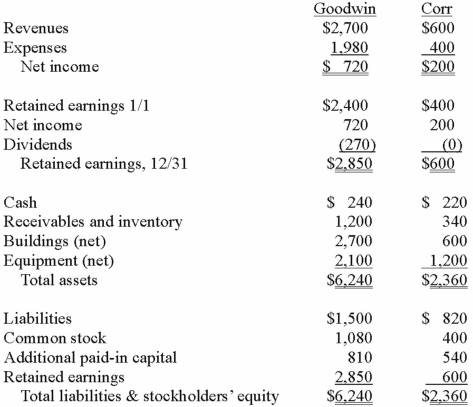

The financial statements for Goodwin, Inc. and Corr Company for the year ended December 31, 2013, prior to Goodwin's acquisition business combination transaction regarding Corr, follow (in thousands) :  On December 31, 2013, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

On December 31, 2013, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

Compute the consolidated revenues for 2013.

Definitions:

Trigger Strategy

A strategy in repeated games where a player's response is conditioned on past behavior, such as retaliating or cooperating based on the other player's previous actions.

Repeated Game

A strategic interaction that occurs multiple times, allowing players to potentially develop strategies based on past outcomes.

Price Competition

A type of competition in which companies try to attract customers by offering lower prices than their competitors.

Equilibrium Payoff

In game theory, the reward or outcome each player expects to receive when all players choose strategies that lead to a stable state where no player can benefit by changing their strategy alone.

Q1: The accounting problems encountered in consolidated intra-entity

Q4: Which is used to calibrate an instrument

Q8: Which of the following is a genetic

Q17: Which of the following translocations results in

Q24: Which is a frameshift mutation?<br>A) Loss of

Q26: Flynn acquires 100 percent of the outstanding

Q35: Thomas Inc. had the following stockholders' equity

Q101: Watkins, Inc. acquires all of the outstanding

Q116: When Jolt Co. acquired 75% of the

Q121: Which one of the following varies between