Flynn acquires 100 percent of the outstanding voting shares of Macek Company on January 1, 2013. To obtain these shares, Flynn pays $400 cash (in thousands) and issues 10,000 shares of $20 par value common stock on this date. Flynn's stock had a fair value of $36 per share on that date. Flynn also pays $15 (in thousands) to a local investment firm for arranging the acquisition. An additional $10 (in thousands) was paid by Flynn in stock issuance costs.

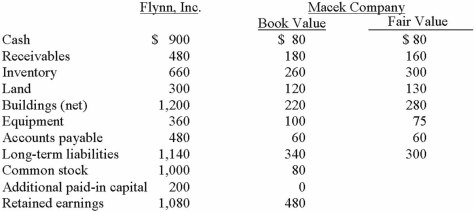

The book values for both Flynn and Macek as of January 1, 2013 follow. The fair value of each of Flynn and Macek accounts is also included. In addition, Macek holds a fully amortized trademark that still retains a $40 (in thousands) value. The figures below are in thousands. Any related question also is in thousands.

What amount will be reported for consolidated long-term liabilities?

Definitions:

Shortcut Menu

A context-sensitive menu that appears when a user right-clicks on an object, offering a list of actions relevant to that object.

Calculated Fields

Fields in a database or spreadsheet where data is generated based on other data fields.

Equal Sign

A symbol (=) used to indicate that two quantities are equal in value or expression.

Field Row

A row in a database or spreadsheet that represents a single record, with each column within the row corresponding to a different field of data.

Q3: The ddNTP:dNTP ratio is too high (too

Q5: Southern blot is used to detect which

Q12: Malignant tissue originating in one organ (primary)

Q23: Thomas Inc. had the following stockholders' equity

Q24: Western blot probes are what type of

Q26: Which of the following is the correct

Q29: On January 1, 2012, Mehan, Incorporated purchased

Q60: Walsh Company sells inventory to its subsidiary,

Q68: Pell Company acquires 80% of Demers Company

Q115: Watkins, Inc. acquires all of the outstanding