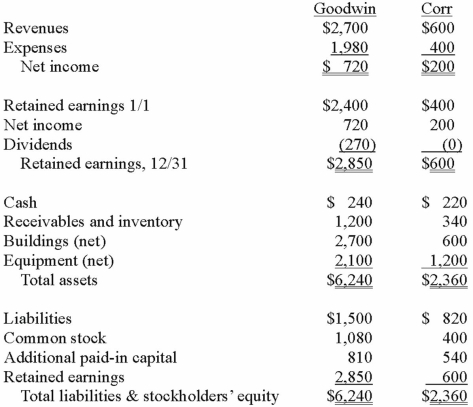

The financial statements for Goodwin, Inc. and Corr Company for the year ended December 31, 2013, prior to Goodwin's acquisition business combination transaction regarding Corr, follow (in thousands) :  On December 31, 2013, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

On December 31, 2013, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

Compute the consolidated equipment (net) account at December 31, 2013.

Definitions:

Society

A group of individuals involved in persistent social interaction, or a large social grouping sharing the same geographical or social territory, typically subject to the same political authority and dominant cultural expectations.

Hypothetical Proposition

A statement in logic that suggests a conditional relationship between two propositions, where one is the consequence of the other.

Disjunctive Proposition

A logical statement that proposes an either/or scenario, where only one of the conditions needs to be true.

Categorical Proposition

A statement that affirms or denies something unconditionally, often structured in standardized forms.

Q3: Beatty, Inc. acquires 100% of the voting

Q8: Jaynes Inc. acquired all of Aaron Co.'s

Q11: What do the products of the HER2/neu

Q12: SYBR Green fluorescence is detectable at which

Q16: A woman has been sexually assaulted by

Q42: Walsh Company sells inventory to its subsidiary,

Q45: On January 1, 2013, Pride, Inc. acquired

Q47: Acker Inc. bought 40% of Howell Co.

Q82: Pell Company acquires 80% of Demers Company

Q99: Dalton Corp. owned 70% of the outstanding