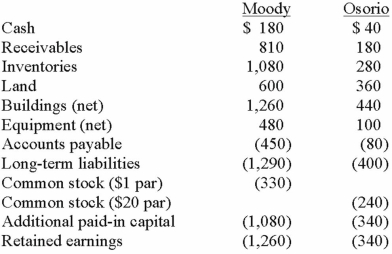

On January 1, 2013, the Moody Company entered into a transaction for 100% of the outstanding common stock of Osorio Company. To acquire these shares, Moody issued $400 in long-term liabilities and 40 shares of common stock having a par value of $1 per share but a fair value of $10 per share. Moody paid $20 to lawyers, accountants, and brokers for assistance in bringing about this acquisition. Another $15 was paid in connection with stock issuance costs. Prior to these transactions, the balance sheets for the two companies were as follows:  Note: Parentheses indicate a credit balance.

Note: Parentheses indicate a credit balance.

In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.

What amount was recorded as goodwill arising from this acquisition?

Definitions:

Expected Return

The forecasted profit or loss from an investment, considering all possible outcomes and their probabilities.

Financial Rewards

Monetary benefits provided to employees or executives, often as a form of incentive or compensation.

High Risk

Refers to investments or financial decisions that carry a high potential for loss in conjunction with the possibility of generating significant returns.

Standard Deviation

A statistical measurement that quantifies the variation or dispersion of a set of data points from its mean, commonly used to gauge volatility in finance.

Q4: Which is used to calibrate an instrument

Q4: Tower Inc. owns 30% of Yale Co.

Q15: Which of the following laboratory methods used

Q18: Which of the following methods has the

Q21: Velway Corp. acquired Joker Inc. on January

Q22: Which of the following methods used to

Q24: A (F508del) mutation in the CFTRgene is

Q33: The following information has been taken from

Q33: Pepe, Incorporated acquired 60% of Devin Company

Q84: On January 4, 2013, Mason Co. purchased