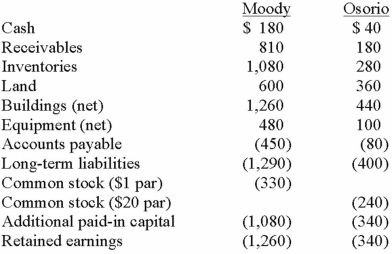

On January 1, 2013, the Moody Company entered into a transaction for 100% of the outstanding common stock of Osorio Company. To acquire these shares, Moody issued $400 in long-term liabilities and 40 shares of common stock having a par value of $1 per share but a fair value of $10 per share. Moody paid $20 to lawyers, accountants, and brokers for assistance in bringing about this acquisition. Another $15 was paid in connection with stock issuance costs. Prior to these transactions, the balance sheets for the two companies were as follows:  Note: Parentheses indicate a credit balance.

Note: Parentheses indicate a credit balance.

In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.

Compute the amount of consolidated common stock at date of acquisition.

Definitions:

Neutrons

Subatomic particles found in the nucleus of an atom, having no electric charge and a mass slightly greater than that of protons.

Electrons

Subatomic particles with a negative electric charge, found orbiting the nucleus of atoms and playing a crucial role in chemical bonds.

Protons

Positively charged subatomic particles found in the nucleus of an atom, contributing to the atom's overall charge and mass.

Molecules

The smallest units of a chemical substance that can exist independently while retaining the properties of the substance.

Q16: In Maxam-Gilbert sequencing, co-migrating bands that are

Q16: A patient presented complaining of slurred speech

Q22: The uniqueness of mitochondrial and Y-STR alleles

Q33: Perch Co. acquired 80% of the common

Q50: What is the difference in consolidated results

Q56: Harrison, Inc. acquires 100% of the voting

Q62: Cayman Inc. bought 30% of Maya Company

Q70: According to the FASB ASC regarding the

Q82: Prior to being united in a business

Q95: Acker Inc. bought 40% of Howell Co.