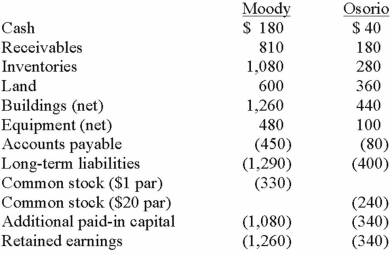

On January 1, 2013, the Moody Company entered into a transaction for 100% of the outstanding common stock of Osorio Company. To acquire these shares, Moody issued $400 in long-term liabilities and 40 shares of common stock having a par value of $1 per share but a fair value of $10 per share. Moody paid $20 to lawyers, accountants, and brokers for assistance in bringing about this acquisition. Another $15 was paid in connection with stock issuance costs. Prior to these transactions, the balance sheets for the two companies were as follows:  Note: Parentheses indicate a credit balance.

Note: Parentheses indicate a credit balance.

In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.

Compute the amount of consolidated buildings (net) at date of acquisition.

Definitions:

Canada

a country in North America known for its vast landscapes, multicultural communities, and a highly developed economy.

Supernatural Elements

Aspects that go beyond the explainable laws of nature, often involving deities, spirits, and other phenomena considered outside scientific understanding.

Durkheim

Emile Durkheim was a French sociologist known for his influential work on sociological theories, including the study of social cohesion, religion, and the division of labor in society.

Sacred

Sacred describes something that is considered holy, divine, or of supreme importance, often associated with religious reverence and ritual.

Q5: Fertilization where one gamete contains an extra

Q6: How do subsidiary stock warrants outstanding affect

Q15: Which of the following laboratory methods used

Q16: The following methods that are used to

Q17: What was the great advantage to molecular

Q19: What would be observed in the event

Q29: Pepe, Incorporated acquired 60% of Devin Company

Q73: On January 1, 2012, Jumper Co. acquired

Q113: Steven Company owns 40% of the outstanding

Q120: From which methods can a parent choose