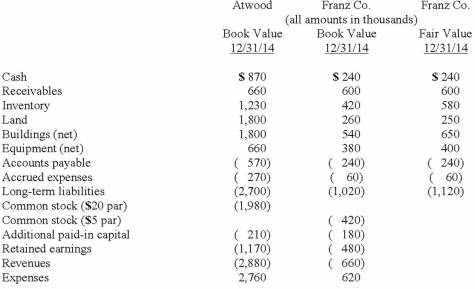

Presented below are the financial balances for the Atwood Company and the Franz Company as of December 31, 2012, immediately before Atwood acquired Franz. Also included are the fair values for Franz Company's net assets at that date.  Note: Parenthesis indicate a credit balance

Note: Parenthesis indicate a credit balance

Assume a business combination took place at December 31, 2012. Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid to effect this acquisition transaction. To settle a difference of opinion regarding Franz's fair value, Atwood promises to pay an additional $5.2 (in thousands) to the former owners if Franz's earnings exceed a certain sum during the next year. Given the probability of the required contingency payment and utilizing a 4% discount rate, the expected present value of the contingency is $5 (in thousands) .

Compute consolidated land at date of acquisition.

Definitions:

Retroactive Interference

A phenomenon in which newer memories impair the retrieval of older memories stored previously.

Memory Construction

The process of forming and integrating new memories, which involves encoding, storage, and retrieval.

Encoding

The act of turning details into a configuration that allows for storage in memory.

Source Amnesia

A memory disorder where a person is unable to remember where, when, or how previously learned information has been acquired, while retaining the factual knowledge.

Q13: Following are selected accounts for Green Corporation

Q16: Pell Company acquires 80% of Demers Company

Q21: Which of the following methods used to

Q55: The financial statements for Goodwin, Inc. and

Q61: McGraw Corp. owned all of the voting

Q86: Hanson Co. acquired all of the common

Q93: What argument could be made against the

Q97: How would you determine the amount of

Q109: Pritchett Company recently acquired three businesses, recognizing

Q113: Why is push-down accounting a popular internal