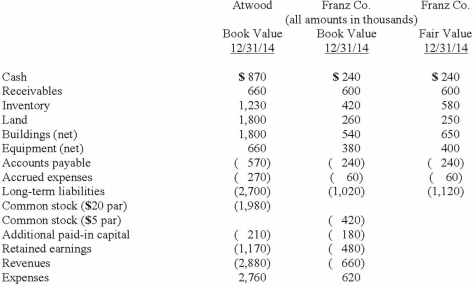

Presented below are the financial balances for the Atwood Company and the Franz Company as of December 31, 2012, immediately before Atwood acquired Franz. Also included are the fair values for Franz Company's net assets at that date.  Note: Parenthesis indicate a credit balance

Note: Parenthesis indicate a credit balance

Assume a business combination took place at December 31, 2012. Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid to effect this acquisition transaction. To settle a difference of opinion regarding Franz's fair value, Atwood promises to pay an additional $5.2 (in thousands) to the former owners if Franz's earnings exceed a certain sum during the next year. Given the probability of the required contingency payment and utilizing a 4% discount rate, the expected present value of the contingency is $5 (in thousands) .

Compute consolidated equipment at date of acquisition.

Definitions:

Whale Intermediates

Transitional fossil forms that provide evidence for the evolutionary lineage of whales from land-dwelling mammals.

Four-Legged

Pertaining to organisms, primarily terrestrial vertebrates, that have four limbs, a characteristic feature of tetrapods including mammals, reptiles, and amphibians.

Land Dwelling Mammals

Mammals that primarily inhabit terrestrial environments, as opposed to aquatic or aerial settings, adapted to various landscapes including forests, deserts, and mountains.

Ocean Islands

Ocean islands are landforms that rise from the ocean floor and are not connected to a continent, often formed by volcanic activity.

Q5: Jans Inc. acquired all of the outstanding

Q7: Prevatt, Inc. owns 80% of Franklin Company.

Q8: What is indicated by the term CYP2A6?<br>A)

Q10: Goehring, Inc. owns 70 percent of Harry

Q11: A DNA sequence with high GC content

Q13: The financial statements for Goodwin, Inc. and

Q13: On January 1, 2013, Deuce Inc. acquired

Q49: Stark Company, a 90% owned subsidiary of

Q57: Gargiulo Company, a 90% owned subsidiary of

Q98: When Jolt Co. acquired 75% of the