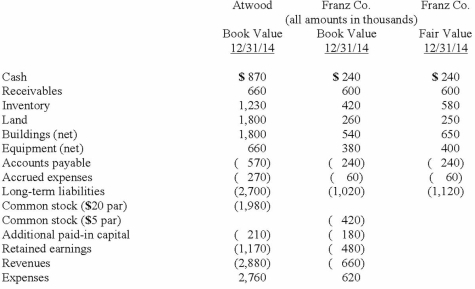

Presented below are the financial balances for the Atwood Company and the Franz Company as of December 31, 2012, immediately before Atwood acquired Franz. Also included are the fair values for Franz Company's net assets at that date.  Note: Parenthesis indicate a credit balance

Note: Parenthesis indicate a credit balance

Assume a business combination took place at December 31, 2012. Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid to effect this acquisition transaction. To settle a difference of opinion regarding Franz's fair value, Atwood promises to pay an additional $5.2 (in thousands) to the former owners if Franz's earnings exceed a certain sum during the next year. Given the probability of the required contingency payment and utilizing a 4% discount rate, the expected present value of the contingency is $5 (in thousands) .

Compute the consolidated cash upon completion of the acquisition.

Definitions:

Payment Options

Various methods available for consumers to make transactions, such as cash, credit cards, and electronic transfers.

Interest Rate

The percentage of a sum of money charged for its use, often expressed annually.

Interest

The cost of borrowing money or the return on investment, typically expressed as a percentage.

Account

A record or report that tracks financial transactions and the financial position of an individual, company, or other organization.

Q24: How many loci are considered core loci

Q27: Gentry Inc. acquired 100% of Gaspard Farms

Q39: Strickland Company sells inventory to its parent,

Q40: Following are selected accounts for Green Corporation

Q47: How does the partial equity method differ

Q49: Stark Company, a 90% owned subsidiary of

Q90: Which of the following statements is true

Q109: Pritchett Company recently acquired three businesses, recognizing

Q111: Pell Company acquires 80% of Demers Company

Q114: Stark Company, a 90% owned subsidiary of