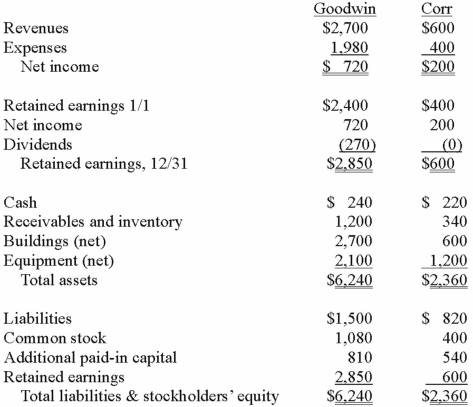

The financial statements for Goodwin, Inc. and Corr Company for the year ended December 31, 2013, prior to Goodwin's acquisition business combination transaction regarding Corr, follow (in thousands) :  On December 31, 2013, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

On December 31, 2013, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

Compute the consolidated revenues for 2013.

Definitions:

Financial Accounting Information

Data derived from an organization's financial statements, providing insight into its financial health, performance, and cash flows to stakeholders.

Efficient Allocation

The process of optimizing the distribution of resources across various activities or investments to achieve the highest possible return or efficiency.

Politically Vulnerable

Refers to individuals or groups that are more likely to suffer from political instability, policy changes, or political decisions due to their lack of power, influence, or resources.

Profitable

A financial state or condition of generating revenue that exceeds the costs and expenses associated with operating.

Q21: Which of the following genes is the

Q24: When a parent uses the initial value

Q72: All of the following statements regarding the

Q74: Clemente Co. owned all of the voting

Q77: Goehler, Inc. acquires all of the voting

Q86: Bullen Inc. acquired 100% of the voting

Q86: Denber Co. acquired 60% of the common

Q111: Fesler Inc. acquired all of the outstanding

Q113: Why is push-down accounting a popular internal

Q114: Dodge, Incorporated acquires 15% of Gates Corporation