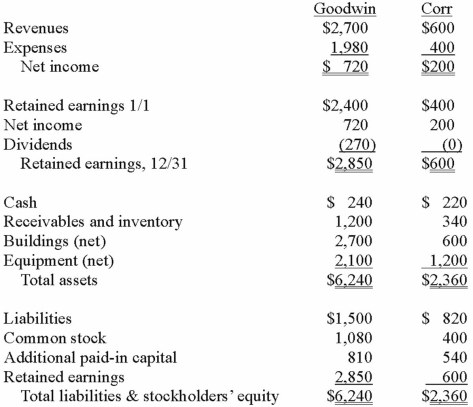

The financial statements for Goodwin, Inc. and Corr Company for the year ended December 31, 2013, prior to Goodwin's acquisition business combination transaction regarding Corr, follow (in thousands) :  On December 31, 2013, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

On December 31, 2013, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

Compute the consolidated common stock account at December 31, 2013.

Definitions:

Brand Name

A distinctive name identifying a product, service, or company, often acting as a signifier of quality and reliability.

Economic Profit

The profit a firm or individual makes after deducting both explicit and implicit costs.

Imperfect Substitutes

Goods or services that can replace each other to some extent, but have differences in features, quality, or price that make them not completely interchangeable.

Brand Names

Names given to products or services by companies to distinguish them from competitors.

Q16: Justings Co. owned 80% of Evana Corp.

Q21: Which are only expressed constitutively on "professional

Q26: Which of the following is the correct

Q29: On January 1, 2013, Parent Corporation acquired

Q71: Presented below are the financial balances for

Q75: The financial statements for Goodwin, Inc. and

Q78: Which of the following is a not

Q80: What is the purpose of the adjustments

Q85: The financial statements for Goodwin, Inc. and

Q111: Pell Company acquires 80% of Demers Company