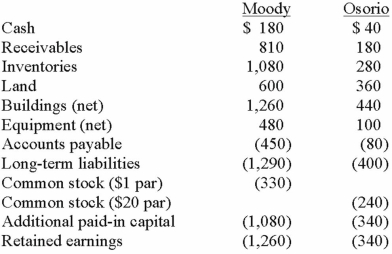

On January 1, 2013, the Moody Company entered into a transaction for 100% of the outstanding common stock of Osorio Company. To acquire these shares, Moody issued $400 in long-term liabilities and 40 shares of common stock having a par value of $1 per share but a fair value of $10 per share. Moody paid $20 to lawyers, accountants, and brokers for assistance in bringing about this acquisition. Another $15 was paid in connection with stock issuance costs. Prior to these transactions, the balance sheets for the two companies were as follows:  Note: Parentheses indicate a credit balance.

Note: Parentheses indicate a credit balance.

In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.

What amount was recorded as goodwill arising from this acquisition?

Definitions:

Token Economy

A behavioral modification technique that involves giving tokens as rewards for desired behaviors, which can later be exchanged for specific privileges or items.

Flooding

A psychological treatment method that exposes the patient to their feared objects or situations extensively and intensively.

Phobias

Irrational and overwhelming fears of objects, creatures, or situations, often leading to avoidance behavior.

Paradoxical Intent

A cognitive therapy technique in which an individual deliberately practices or exaggerates a feared behavior or thought in order to diminish its power.

Q2: A patient's diagnosis is ataxia-telangiectasia. The physician

Q10: Down's syndrome is caused when an extra

Q10: What type of PCR starts with an

Q21: Which of the following translocations can be

Q24: For each of the following numbered situations

Q31: How are direct and indirect costs accounted

Q48: On 4/1/11, Sey Mold Corporation acquired 100%

Q97: On January 4, 2013, Mason Co. purchased

Q108: Which of the following results in an

Q110: On January 3, 2013, Roberts Company purchased