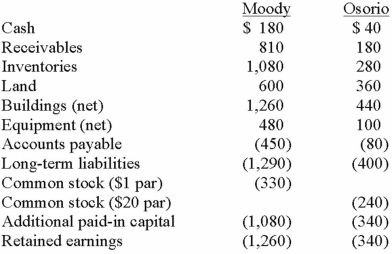

On January 1, 2013, the Moody Company entered into a transaction for 100% of the outstanding common stock of Osorio Company. To acquire these shares, Moody issued $400 in long-term liabilities and 40 shares of common stock having a par value of $1 per share but a fair value of $10 per share. Moody paid $20 to lawyers, accountants, and brokers for assistance in bringing about this acquisition. Another $15 was paid in connection with stock issuance costs. Prior to these transactions, the balance sheets for the two companies were as follows:  Note: Parentheses indicate a credit balance.

Note: Parentheses indicate a credit balance.

In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.

Compute the amount of consolidated common stock at date of acquisition.

Definitions:

Ordered Pairs

Pairs of numbers used to represent points on a graph, with the first number indicating horizontal position and the second number vertical position.

Function

In mathematics, a relation between a set of inputs and a set of permissible outputs with the property that each input is related to exactly one output.

Simplify

In mathematics, to reduce an expression or equation to its simplest form or most understandable version.

Evaluate

The act of determining the worth of a given expression.

Q15: In a PCR assay of DNA isolated

Q24: Mutations in which of the following oncogenes

Q25: What defines a congenital disease?<br>A) Always heritable<br>B)

Q28: A polymorphism is distinguished from a mutation

Q29: Which of the following is the most

Q31: Pell Company acquires 80% of Demers Company

Q34: Renfroe, Inc. acquires 10% of Stanley Corporation

Q34: Gargiulo Company, a 90% owned subsidiary of

Q71: Fesler Inc. acquired all of the outstanding

Q85: The financial statements for Goodwin, Inc. and