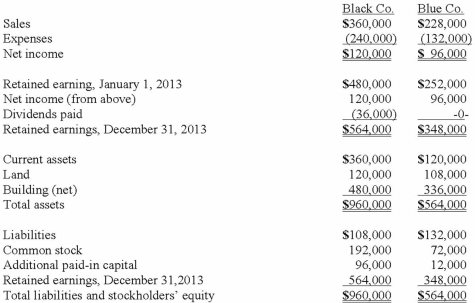

The following are preliminary financial statements for Black Co. and Blue Co. for the year ending December 31, 2013.

On December 31, 2013 (subsequent to the preceding statements), Black exchanged 10,000 shares of its $10 par value common stock for all of the outstanding shares of Blue. Black's stock on that date has a fair value of $50 per share. Black was willing to issue 10,000 shares of stock because Blue's land was appraised at $204,000. Black also paid $14,000 to several attorneys and accountants who assisted in creating this combination.

Required:

Assuming that these two companies retained their separate legal identities, prepare a consolidation worksheet as of December 31, 2013.

Definitions:

Imported

Products or services imported from another country for the purpose of selling them.

Exported

Offerings or goods conveyed from one country to another for the objective of transaction or sale.

Production Possibilities Frontier

A curve demonstrating the maximum feasible amount of two goods that can be produced with available resources and technology.

Bowed Out

A graphical representation showing increasing opportunity costs, indicating that resources are not perfectly adaptable for producing different goods.

Q2: A molecular biologist is to separate and

Q11: Which whole blood fraction is the most

Q13: Which is the proper order for the

Q14: A positive control is added (spiked) into

Q17: An analysis that takes place in silico

Q48: On 4/1/11, Sey Mold Corporation acquired 100%

Q63: Which of the following internal record-keeping methods

Q67: One company buys a controlling interest in

Q69: On January 1, 2012, Franel Co. acquired

Q98: Cashen Co. paid $2,400,000 to acquire all