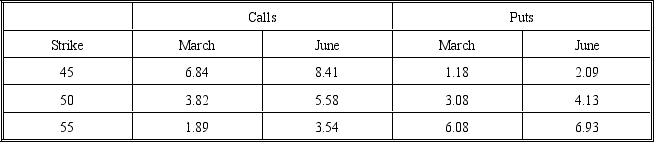

The following prices are available for call and put options on a stock priced at $50.The risk-free rate is 6 percent and the volatility is 0.35.The March options have 90 days remaining and the June options have 180 days remaining.The Black-Scholes model was used to obtain the prices.

Use this information to answer questions 1 through 20.Assume that each transaction consists of one contract (for 100 shares) unless otherwise indicated.

Use this information to answer questions 1 through 20.Assume that each transaction consists of one contract (for 100 shares) unless otherwise indicated.

Answer questions 18 through 20 about a long box spread using the June 50 and 55 options.

-What is the cost of the box spread?

Definitions:

Common Stock

A form of corporate equity ownership, a type of security representing ownership in a corporation.

Acquisition Method

A collection of accounting methods utilized to combine the financial reports of a parent company with those of its subsidiary companies.

Consolidated Equipment

The aggregate of equipment assets combined from parent and subsidiary entities for the purpose of financial reporting.

Par Value

The face value of a bond or stock as stated by the issuer, which is not indicative of its market value.

Q12: Suppose it is currently July. The September

Q16: One of the first automated trading systems

Q21: The wild card option exists because of

Q21: At expiration the call price must converge

Q23: The 260 nm/280 nm ratio for isolated

Q23: Which of the following does not play

Q24: The cost of portfolio insurance is the

Q54: In the context of insurance, protective put

Q59: The coupon assumption for the conversion factor

Q65: An investor who exercises a call option