The following information pertains to questions

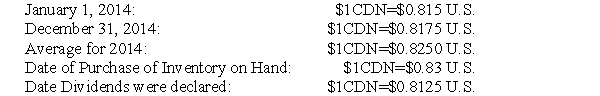

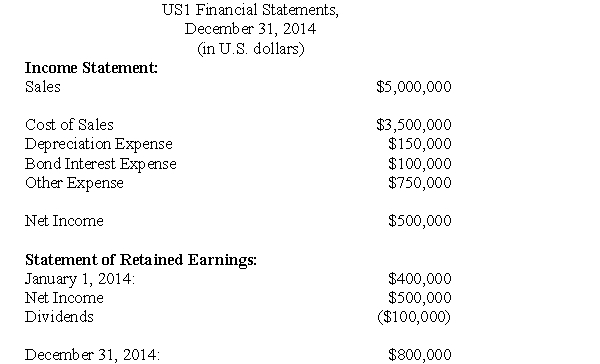

ABC Inc has a single wholly-owned American subsidiary called US1 based in Los Angeles,California which was acquired January 1,2014.US1 submitted its financial statements for 2014 to ABC.Selected exchange rates in effect throughout 2014 are shown below:  US1 Financial Results for 2014 were as follows:

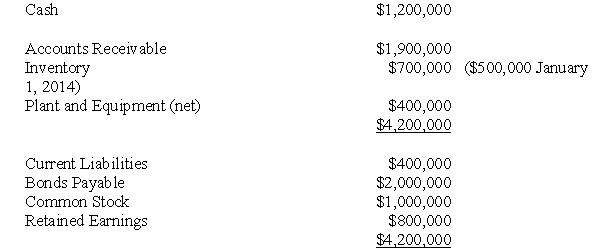

US1 Financial Results for 2014 were as follows:  Balance Sheet

Balance Sheet  For questions 17 through 22,inclusively,assume that US1 is considered to be a self-sustaining subsidiary.

For questions 17 through 22,inclusively,assume that US1 is considered to be a self-sustaining subsidiary.

-Which of the following rates would be used to translate the company's Income Statement items?

Definitions:

General Journal

A ledger where all financial transactions of a business are initially recorded using double-entry bookkeeping.

Purchases Journal

A financial journal used to record all purchases of goods and services on credit.

Return Supplies

Returned goods or materials that were previously purchased, which can reduce the payable amount or be exchanged for credit.

Account Recorded

This refers to the entry or documentation of financial transactions in the appropriate accounts within a company's financial records.

Q4: Calculate Consolidated Retained Earnings as at June

Q12: On the date of acquisition,the parent's investment

Q24: Under IFRS 10,when can a venturer recognize

Q26: Three different divisions of a toy manufacturing

Q38: What is the amount of non-controlling interest

Q40: SXF sells its single product for $14

Q42: Which of the following rates would be

Q89: The total cost of salaries of production

Q101: Julie's Jewels sells cubic zirconium (fake diamond)rings

Q114: Open-ended problems are not often seen in