The following information pertains to questions

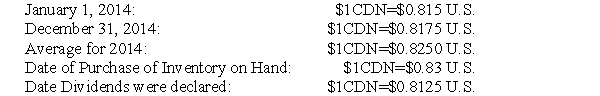

ABC Inc has a single wholly-owned American subsidiary called US1 based in Los Angeles,California which was acquired January 1,2014.US1 submitted its financial statements for 2014 to ABC.Selected exchange rates in effect throughout 2014 are shown below:  US1 Financial Results for 2014 were as follows:

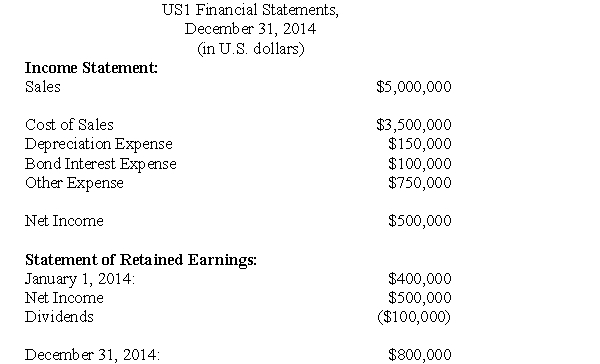

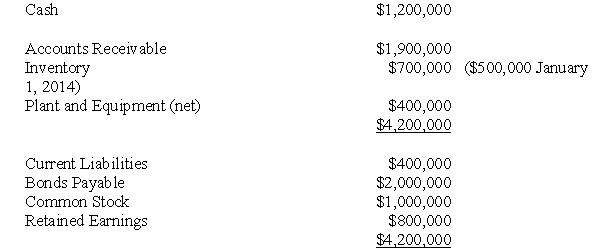

US1 Financial Results for 2014 were as follows:  Balance Sheet

Balance Sheet  For questions 17 through 22,inclusively,assume that US1 is considered to be a self-sustaining subsidiary.

For questions 17 through 22,inclusively,assume that US1 is considered to be a self-sustaining subsidiary.

-Which of the following rates would be used to translate the company's inventory?

Definitions:

Call Bonds

Bonds that can be redeemed by the issuer before their maturity date, typically at a premium, giving issuers flexibility in refinancing opportunities.

Market Interest Rates

The prevailing rate of interest available in the marketplace on loans and deposits, influenced by factors such as supply and demand, government policy, and economic conditions.

Bond Price

The market value of a bond, which can fluctuate based on interest rates, market conditions, and the credit quality of the issuer.

Interest Rate

The percentage charged on a loan or paid on deposits over a specific period, representing the cost of borrowing or the earnings from saving.

Q4: Assuming that GNR owned 80% of NXR

Q13: (CMA)A widely used approach that is used

Q24: If a parent company borrows money from

Q27: Assume that Parent Inc.decides to prepare an

Q33: Where should endowment contributions be presented in

Q42: The amount of non-controlling interest in earnings

Q48: Financial statements are:<br>A)External reports produced from an

Q54: The breakeven sales volume of the Tuck

Q60: What is the required adjustment to ABC's

Q147: SBN Corporation produces and sells custom cabinets.