The following information pertains to questions

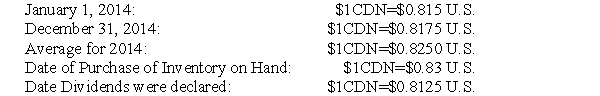

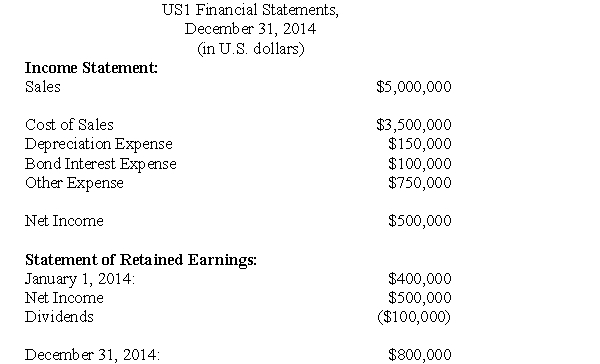

ABC Inc has a single wholly-owned American subsidiary called US1 based in Los Angeles,California which was acquired January 1,2014.US1 submitted its financial statements for 2014 to ABC.Selected exchange rates in effect throughout 2014 are shown below:  US1 Financial Results for 2014 were as follows:

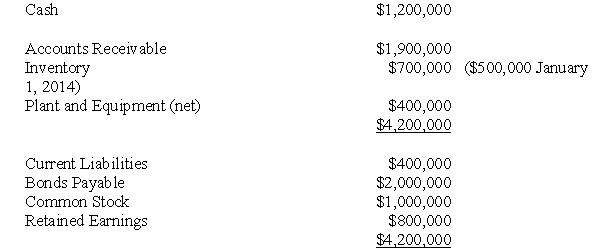

US1 Financial Results for 2014 were as follows:  Balance Sheet

Balance Sheet  For questions 17 through 22,inclusively,assume that US1 is considered to be a self-sustaining subsidiary.

For questions 17 through 22,inclusively,assume that US1 is considered to be a self-sustaining subsidiary.

-Which of the following rates would be used to translate the company's Common Stock?

Definitions:

Productive Cough

A cough that results in the expulsion of mucus or phlegm from the respiratory tract.

Peripheral Intravenous Catheter

A medical device inserted into a peripheral vein, typically in the hand or arm, to administer fluids, medications, or to draw blood.

Catheter-associated

Refers to conditions or infections that occur in connection with the use of a catheter, typically used for draining urine.

Antimicrobial-resistant

Refers to microorganisms, like bacteria and viruses, that have evolved to survive medications designed to kill or inhibit their growth.

Q7: Compute MAX's Consolidated Net Income for 2009.

Q8: Prepare a partial Balance Sheet for Canada

Q8: What amount of interest expense (if any)would

Q29: Which of the following is not an

Q30: Uncertainties and biases do not affect external

Q33: What is the amount of the non-controlling

Q40: What would be the journal entry to

Q53: The relevant range is defined as:<br>A)The period

Q64: Ruben, Inc. is a management consulting firm

Q83: The Harris Co. sells three products in