The following information pertains to questions

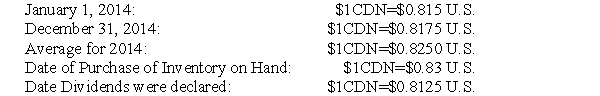

ABC Inc has a single wholly-owned American subsidiary called US1 based in Los Angeles,California which was acquired January 1,2014.US1 submitted its financial statements for 2014 to ABC.Selected exchange rates in effect throughout 2014 are shown below:  US1 Financial Results for 2014 were as follows:

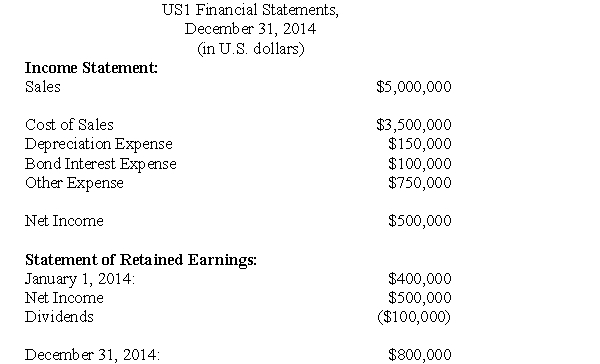

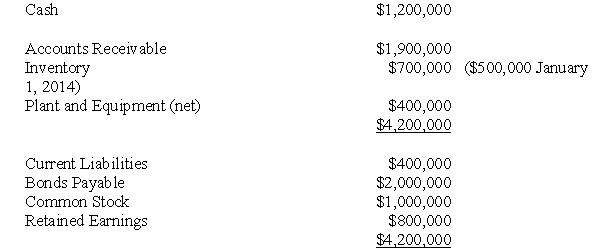

US1 Financial Results for 2014 were as follows:  Balance Sheet

Balance Sheet  For questions 17 through 22,inclusively,assume that US1 is considered to be a self-sustaining subsidiary.

For questions 17 through 22,inclusively,assume that US1 is considered to be a self-sustaining subsidiary.

-What is the amount of the gain or loss arising from translation?

Definitions:

QRS Complex

A series of three deflections on an electrocardiogram (ECG) representing the electrical activity during the ventricular contraction phase of the heart cycle.

ECG

Electrocardiogram, a diagnostic tool that records the electrical activity of the heart, used to detect heart conditions by measuring the timing and duration of each electric phase in the heartbeat.

QRS Complex

A series of deflections in an electrocardiogram (ECG) representing ventricular depolarization before the main pumping action of the heart.

Atrial Repolarization

The process where atrial muscle cells return to their resting state during the cardiac cycle.

Q9: An impairment loss can be reversed when<br>A)the

Q15: Franco's Flowers is a wholesale flower shop

Q25: Which of the following is NOT currently

Q31: Total fixed costs are $20,000 per month

Q34: What would be the balance in the

Q34: What is the amount of the premium

Q49: Heesacker Co. sells a product with a

Q55: RSE Corporation sells its product for $10

Q59: Which of the following is the most

Q104: Suppose you are a newly hired accountant