The following information pertains to questions

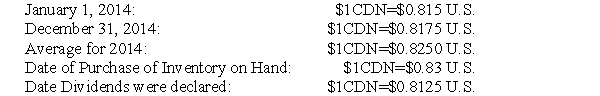

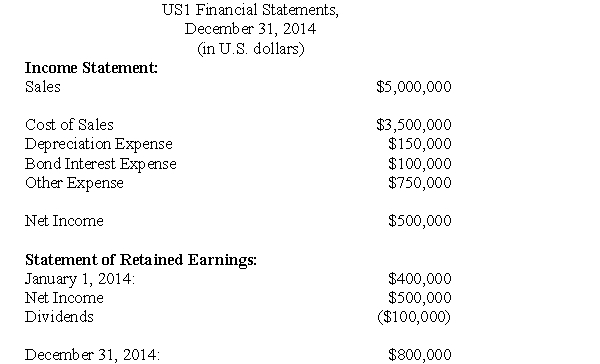

ABC Inc has a single wholly-owned American subsidiary called US1 based in Los Angeles,California which was acquired January 1,2014.US1 submitted its financial statements for 2014 to ABC.Selected exchange rates in effect throughout 2014 are shown below:  US1 Financial Results for 2014 were as follows:

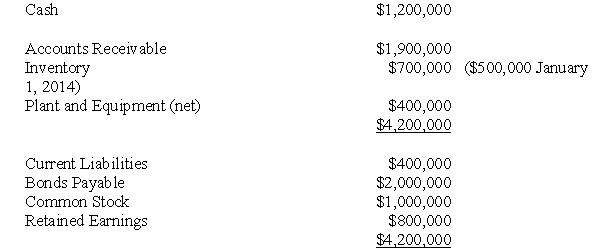

US1 Financial Results for 2014 were as follows:  Balance Sheet

Balance Sheet  For questions 17 through 22,inclusively,assume that US1 is considered to be a self-sustaining subsidiary.

For questions 17 through 22,inclusively,assume that US1 is considered to be a self-sustaining subsidiary.

-For the sake of simplicity,assume that US1's cost of sales was calculated to be $4,000,000 CDN.What is the amount of the gain or loss arising from translation?

Definitions:

Internet

A global network of computers and servers that enables the exchange of data, communication, and access to information.

Product Placement

A marketing strategy where branded goods or services are placed in a context usually devoid of ads, like movies or TV shows.

Product Advertisements

Marketing communications that promote and provide information about goods to entice potential buyers.

Objectives

Specific, measurable goals that are planned to achieve a broader aim or strategy.

Q13: Which of the following statements best describes

Q18: What would be the gain or loss

Q21: Assuming that Davis purchases 100% of Martin

Q23: Compute Martin's exchange gain or loss for

Q29: ABC Inc.has acquired all of the voting

Q34: The amount of non-controlling interest appearing on

Q44: Accounting information is used to monitor operations

Q52: What would be the balance in Hanson's

Q61: Which of the following is NOT used

Q72: Tilker Manufacturing sells its product for $40