The following information pertains to questions

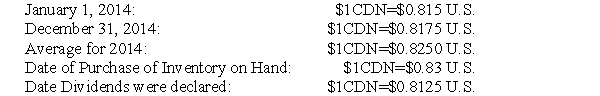

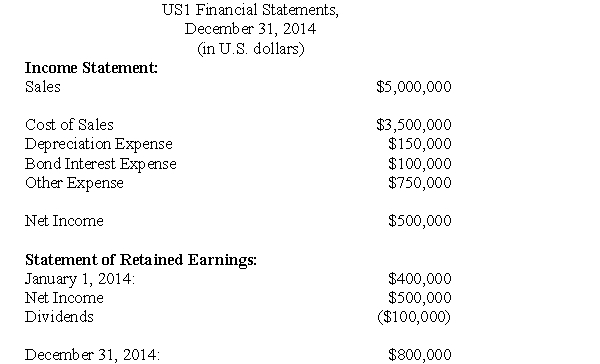

ABC Inc has a single wholly-owned American subsidiary called US1 based in Los Angeles,California which was acquired January 1,2014.US1 submitted its financial statements for 2014 to ABC.Selected exchange rates in effect throughout 2014 are shown below:  US1 Financial Results for 2014 were as follows:

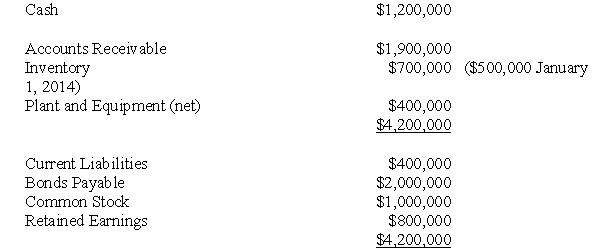

US1 Financial Results for 2014 were as follows:  Balance Sheet

Balance Sheet  For questions 17 through 22,inclusively,assume that US1 is considered to be a self-sustaining subsidiary.

For questions 17 through 22,inclusively,assume that US1 is considered to be a self-sustaining subsidiary.

-Which of the following rates would be used to translate the company's depreciation expense for the year?

Definitions:

Ethnic Minority Member

An individual belonging to a smaller ethnic or cultural group within a larger community, often distinguished by customs, language, or religious practices.

Stigmatized Group

A social group that is negatively discriminated against and marginalized due to characteristics deemed undesirable by society.

Vigilant to Prejudice

The state of being acutely aware of and actively responsive to instances of prejudice or discrimination.

Willing to Cooperate

A disposition or readiness to work together with others towards common goals or interests.

Q4: Which of the following acquirees assets and

Q13: Consolidated Retained Earnings include:<br>A)Consolidated Net Income less

Q45: What would be the journal entry to

Q53: Selectron Inc acquired 60% of Insor Inc.on

Q125: Managers might estimate a cost function for

Q127: Data extracted from the accounting information system

Q131: If the selling price per unit and

Q137: SXF sells its single product for $14

Q146: The depreciation on a factory machine is

Q179: NTQ Corporation produces and sells a single